We own a portion of a business. We do not trade stocks for short-term profits.

Investment approach

Look for outstanding Businesses

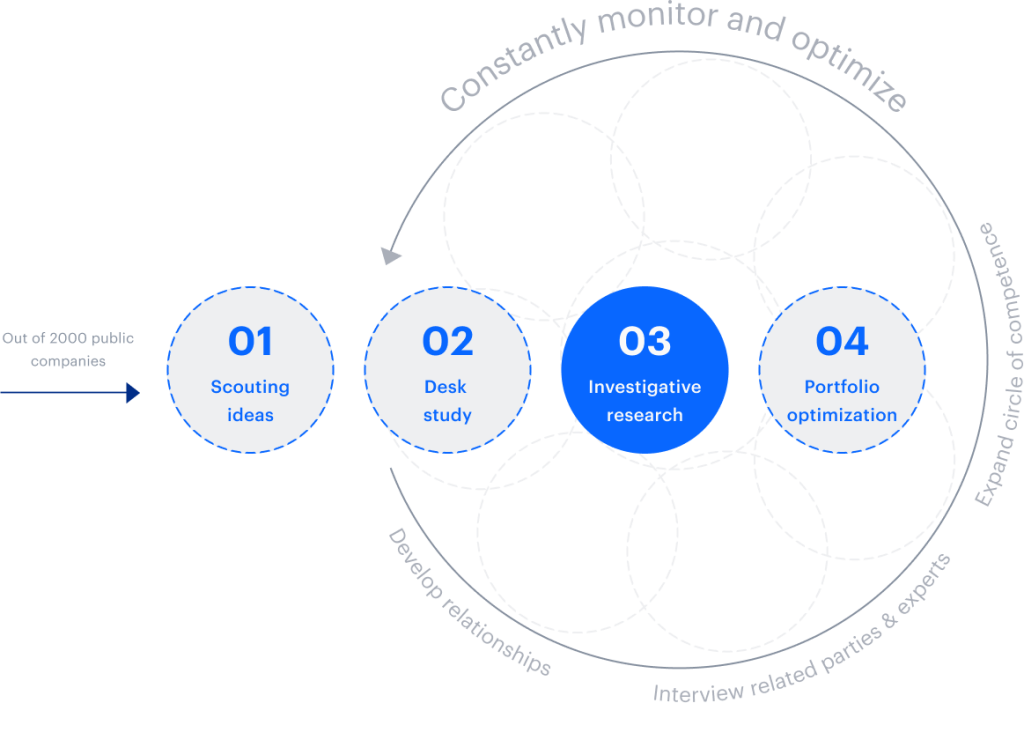

We search for the most outstanding businesses in Vietnam, run by honest and capable people. Out of thousands of public companies, the AP Alpha team believes our most important decision is to choose those most deserving of our time and constant monitoring. Very few listed companies meet our strict standards.

Perform thorough business inspection

We follow a diligent business inspection process which involves desk study, investigative research and interviews with stakeholders. Sometimes, we also actively participate in management activities. This multi-faceted approach helps us to develop deeper insights about the businesses we invest in. We believe this is the only way we can be prepared for big events (market-driven or company-driven) that would significantly impact share prices. Thereby, we can quickly take advantage of such events and make the most beneficial decisions for our investors.

We do not over-diversify

We focus on quality rather than quantity, only investing in a few businesses we have a deep understanding of and at a reasonable price. We believe owning too many businesses which we do not truly understand will increase rather than reduce risk. With more than 15 years of investment experience, this approach has helped us sustainably outperform the market and minimize the risk of capital loss in the long term.

Optimize investment portfolio

The AP Alpha team does not rest with an indefinite buy and hold strategy. We will adjust the weight of the businesses in our portfolio when there are significant changes to their prices. The cheaper the business, the more we would like to own it. Conversely, the more expensive the business, the less we are inclined to own.

AP Alpha does not believe in predicting the market in the short term

Accurately predicting the market on a regular basis is impossible and down to luck. Thus, we do not spend our efforts on guessing if the market will rise or fall in the short term. Rather, we will focus on trying to find profitable businesses with a strong cash flow, a solid growth potential and are currently valued below their intrinsic values on the market.

What happens in the short term

In the short term, stock prices will fluctuate with the market. Factors such as global and local politics, investor sentiment and short term supply and demand can cause stock prices to move unpredictably. Profits can be made if we guess correctly but we can also suffer with wrong timing.

Inherently unpredictable

(at least for us)

What happens in the long term

In the long term, stock prices will reflect fundamental factors such as the companies’ competitive position, management quality and profit growth.

Mostly explainable

(with much research efforts)