29-11-2021

Nov 29, 2021 – Investor Letter

To the investors,

In the 3rd Quarter of the year, especially in October and November, the stock market had witnessed countless waves of blindfolded speculations, just like what we discussed at the beginning of the year. The crazy trading sessions on 12th November 2021 marked the peak of the waves with 200 stock tickers whose prices skyrocketed to the ceiling, in which 125 came from UpCOM, an exchange for those who are unqualified to be listed on HOSE. Many perennial investors celebrated as they witnessed their past investing mistakes, which resulted in loss of liquidity and inability to divest, suddenly got traded in high volume at unbelievable prices.

Undoubtedly, lots of inexperienced investors will bear losses after this game of “cheat gambling”. The one thing that we concern about the most, is whether the market has become too greedy? Usually, penny stocks become the popular choices is exactly the signal that the market is reaching its peak and recessions are coming. We are carefully observing whether just inexperienced investors got carried away by this trend of penny stock speculation, or so do professional investors, too?

In terms of performance, basically all companies that we hold stock shares experience growth in the third quarter. The Basic Ingredients sector is experiencing strong growth through short-term disturbance in the supply chain. The banks are also experiencing growth in credit, and bad debts are being kept under control through aggressive provisioning. Retail and consumer appliances are sectors that were heavily affected by the pandemic, but revenues bounced back impressively in October, mostly thanks to accumulated demands as the result of social isolation.

Looking into the future, we observe that this Lockdown had caused a really huge disorientation to the normal life of a majority of urban residents with middle to lower income. This has led to significant changes in the market structure, as well as the spending habits in major urban areas like Ho Chi Minh City. Retail and household goods companies will need time to change and adapt to this “new” normal condition. This presents not only the challenges but also the chances to break through for the excellent competitors. The pandemic created a huge gap in the market. This is a one-in-a-lifetime opportunity for the giants to take advantage and gain more market shares. On the investor’s side, this is the time to be patient and accumulate more when opportunity comes.

With a broader view, we are aware of three macroeconomics issues that might affect the company we are invested in and the assets we hold, specifically:

First, the coverage of the second vaccine injection in Vietnam is still narrow, while many of the vaccines used in Vietnam have yet to be confirmed to create social immunity in any other countries. This might present a risk of uncertainty for the projection that economics activities will resume to normal states in the second half of 2022. Even within the developed nations, Covid still spreads quietly within the society even after the total coverage of the second vaccine injection; although this does not create widespread fear, the economy still suffers no less than the first time.

Second, worldwide inflation situation has been quite persistent, which will make it harder for the Central Banks to loosen the monetary policies; FEDs are coming close to increasing interest rates at the end of 2022. This will cause the switch in equity flow from EM to DM for a short period of time, just like what happened in 2018, as well as heavy effect on the commodity market. The positive note is that Vietnam’s inflation rate is still in control at around 4%, and foreign exchange reserves keep increasing, to a record level of USD 114 billion in 2021. Additionally, foreign investors no longer play a big role as before in the Vietnam stock market.

Third, newly mutated variants of the pandemic virus will present a significant risk, further lengthening the disorientation period and suspension in economic activities. Income level of the middle class is slowly degrading. Overall productivity and efficiency of the society decreases. Goods are produced in less quantity and with higher costs than before. These are risk factors that we are unable to quantify. The only thing we can do is to be conservatively optimistic; not to fear and also not to get carried away by the excitement in the market.

On a last note, we view the pandemic as just another strong natural selection process. After all of these, the weak will be gone and only the stronger ones will still be around with more available resources and market opportunities. Knowledge, the core value of the economy and the factor determining the productivity, is still there; goods will keep being created, but with a different way to divide the pie. Those who survived will enjoy a much bigger piece of the pie. Our capital needs to find the strongest ones to hide in and wait for the right opportunity to get even stronger.

PERFORMANCE REPORT Q3/2021 – AP FOUNDER PORTFOLIOS

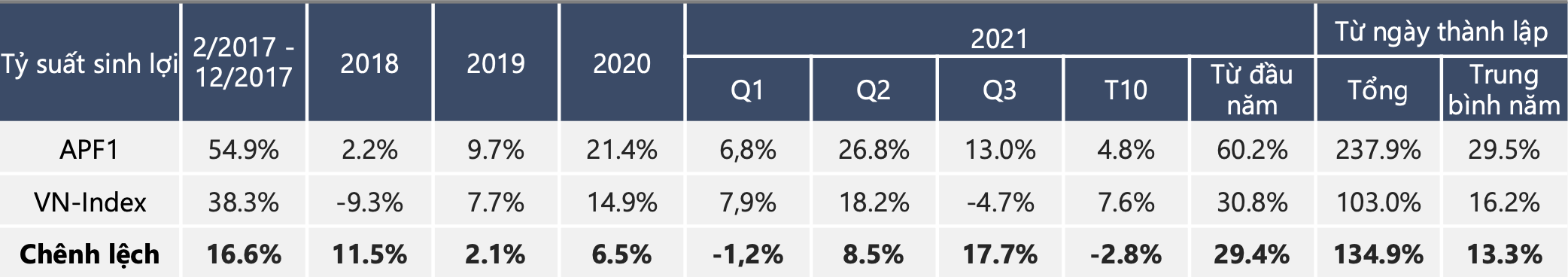

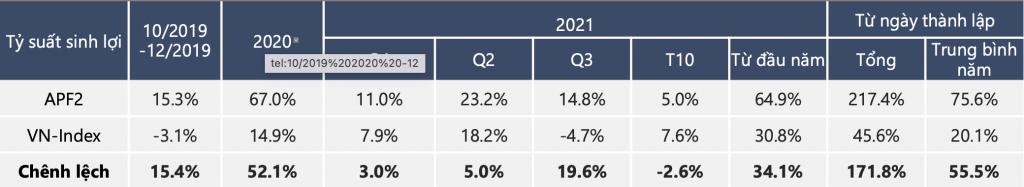

As of 20th October 2021, Vietnam stock market has grown 30.8% compared to the beginning of the year. APF1 and APF2 portfolios had concluded the month of October with an NAV per Investment Unit value of VND 33,790 and VND 31,741, respectively, which are equivalent to growth rates of 60.2% and 64.9% compared to the beginning of the year.

Counting from the initiation, total investment returns for both portfolios are as follows:

Revenue and profit growth of companies we own:

At the end of October, the Companies took turns to release the financial reports for Q3. In that regard, all Companies that we invested in had reported a growth of 14% in revenue and 33% in profit for the 3rd Quarter. Counting the first 09 months of this year, the Companies in our portfolio achieved an average growth rate of 28% in revenue and 59% in profit.

We forecast a yearly growth rate of 24% in revenue and 45% in profit for the year 2021. For 2022, growth rate will be slower at 19% for revenue and 20% for profit.

Sincerely,

Pham Anh Vu

Founder