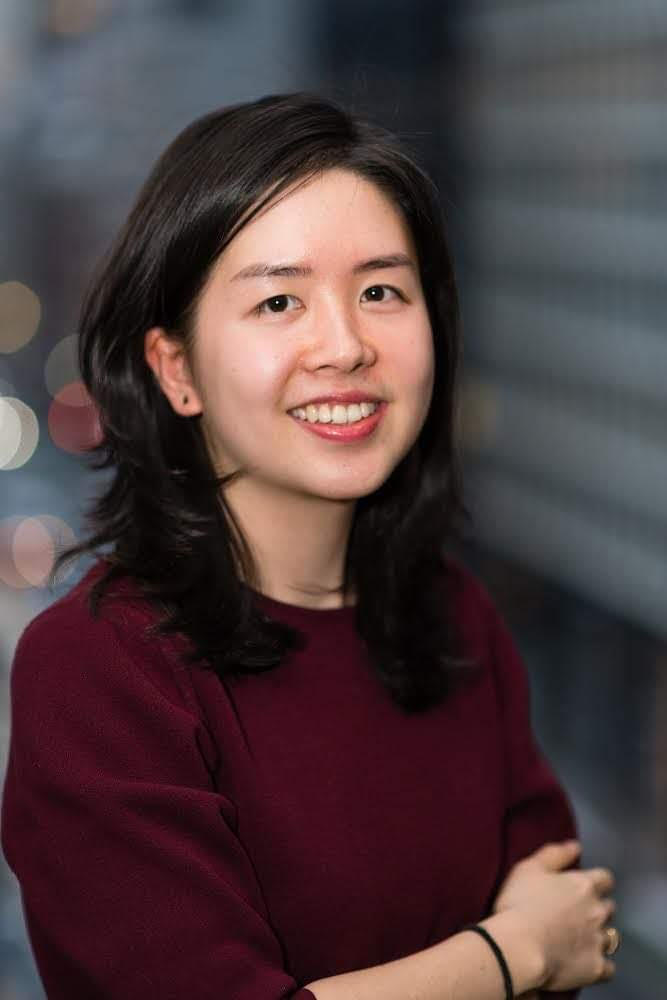

VVI Tour Learn Earn More Seminar

AP Alpha founder attended the VVI Tour Learn More Earn More seminar at the Sheraton Saigon Hotel in July as a panelist in the talk show “Fund Talks on Vietnam stocks”, alongside two other investment experts – Mr. Bill Stoops, CIO of Dragon Capital, and Mr. Vu Huu Dien, Portfolio Manager of VEIL Investment Fund. …

Read more